The city’s streets are increasingly under water, but home buyers have a hard time discovering a house’s flood history, and owners run a gauntlet of red tape to make repairs.

|

Listen To This Story

|

This story is part of WhoWhatWhy’s series about how climate change is affecting towns across America. Each member of our reporting team “adopted” a town; looked into the climate-caused problems it faces, from floods to fires; asked local experts and residents about unusual weather patterns they’ve witnessed; and quizzed town officials about any plans they have to address the challenges posed by a warming world.

Sharon Richardson moved to Charleston, SC, with her three daughters to pursue a job in coastal conservation.

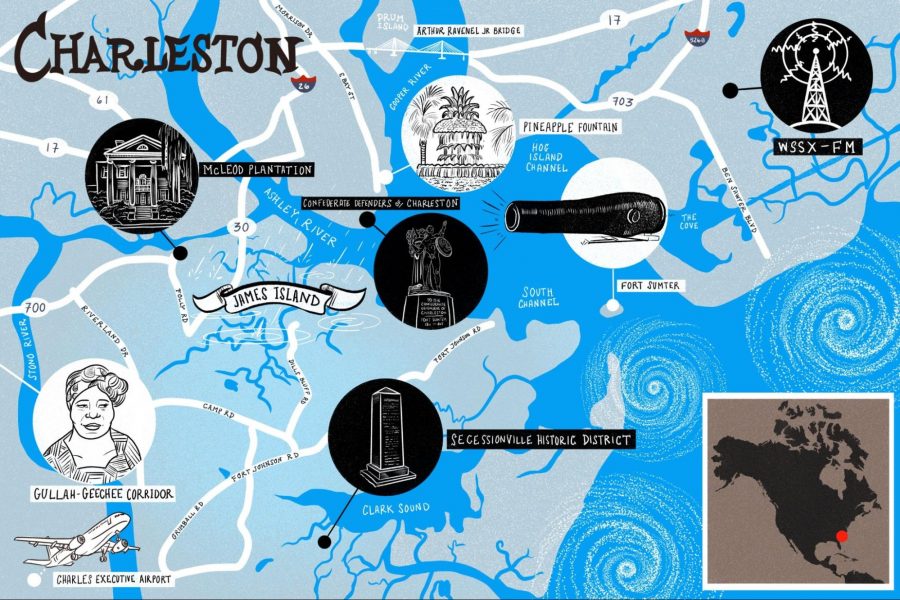

“[It] was a really good, safe place,” she thought, after finding a new home on James Island, south of downtown, with a high school nearby that seemed like a perfect fit for her daughters.

Of course, Richardson knew the area was experiencing more flooding as a result of climate change and that the problem would only worsen, but she took the gamble, reasoning that the house was newly constructed and elevated to let floodwaters flow through the garage.

After just six weeks, however, Richardson and her daughters watched Hurricane Joaquin transform Charleston’s cobblestone streets into a network of shallow canals.

That was in 2015. Two years later, on September 11, 2017, Richardson nearly lost her home. “The ocean was coming up out of the marsh,” she recounted, “and all of a sudden it just accelerated so quickly because the water has nowhere to go except up.” Hurricane Irma formed moats surrounding Richardson’s home and those of her neighbors.

“When the water rose,” she said, “I definitely started to panic because I was like, I cannot drive out of here now. I am stuck.” Richardson felt a sense of helplessness as she realized how a situation that didn’t seem threatening at first could quickly take a dangerous turn. “Had the tide kept coming in … the house would have been underwater.”

Fortunately, the floodwaters stopped in her yard, and the house was spared.

“Data is clearly showing a direct correlation between increased warming of ocean water, the atmosphere, and coastal flooding,” said Vijay Vulava, a professor of environmental geochemistry at the College of Charleston. “The flood events are becoming more frequent as well as more severe.”

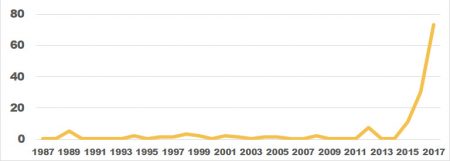

Here’s how Charleston has been affected since Richardson moved in:

In 2015: The city experienced a 1,000-year flood event — statistically speaking, a flood with a 1 in 1,000 chance of occurring in any given year. Hurricane Joaquin, a Category 4 storm, battered Charleston and resulted in viral photos of people standing waist-deep in water or kayaking through downtown streets. Flash flooding caused significant damage to properties and infrastructure, and many people had to be rescued by emergency workers.

In 2016: Charleston set a new record for the number of days of tidal flooding. The same year, Hurricane Matthew slammed into the coast just south of Charleston. After Matthew, the City of Charleston asked the Federal Emergency Management Agency (FEMA) for $10 million in mitigation funding for property buyouts but was denied.

In 2017: Hurricane Irma brought the worst tidal surge since Hurricane Hugo in 1989.

In 2018: Hurricane Florence brought heavy rainfall to the state, causing significant damage in

Georgetown County, north of Charleston.

In 2019: Coastal South Carolina flooded a record 89 times. The City of Charleston

was found to underreport flood damages, failing to recognize some repetitive loss properties

and severe repetitive loss properties and thereby preventing homeowners from obtaining mitigation funding.

In 2020: Coastal South Carolina recorded its second-highest number of flooding events. FEMA announced that its investigation into the construction of 19 homes on James Island in the late 1980s had found “indications of fraud.” The builder had constructed the homes several feet below FEMA’s requirements but was granted permission to let the homeowners live there anyway.

In 2021: Hurricane Elsa flooded the streets of downtown Charleston once again.

The Folly of Mitigating a Constant Crisis

Kristopher Fowler bought his first house on James Island in 2013, thinking it would be a good investment. He had no idea that he had moved onto a severely flood-prone property, and it wasn’t long before the first high water came. His property flooded three times in the three years he lived there, and he would later discover that it had flooded five times before he moved in.

Fowler received money from the National Flood Insurance Program to restore his house after the first two floods, but he didn’t bother to submit a claim after the third because the repairs from the second still hadn’t been completed. He tried to obtain funding to elevate the structure, but Charleston County had no money for mitigations, which are efforts to reduce a property’s future flood risk.

The last thing Fowler wanted to do was pass the burdensome home onto someone else without letting them know what they were getting into, so he disclosed its flood history to potential buyers, even leaving a hole in one of the walls to expose underlying flood damage. He was considering letting his home go into foreclosure when someone bought it anyway.

While living there, Fowler received several flood insurance payouts in excess of $20,000, and previous owners had received more than $100,000, to rebuild the home after floods. He compares the payouts, which were just enough to fix the damages, to putting a Band-Aid over the problem. “If you keep putting money like that into a property without fixing the original cause of the problem,” he said, “then it’s just going to keep getting worse.”

Every year, more and more people in coastal South Carolina find themselves in a similar situation — unable to obtain mitigation funding for their homes while living in fear of the next flood. Wealthier families may be able to pay out-of-pocket to elevate their homes, but that can cost well over $100,000, as in Fowler’s case. Without funding for buyouts, residents struggle to sell their homes and are then unable to move out of the floodplain.

Competing for Aid

Residents of Charleston County and other coastal communities across the nation rely on insurance provided by the National Flood Insurance Program (NFIP), administered by FEMA. To participate in the program, communities must adhere to FEMA’s floodplain management requirements.

Some of the properties covered by the NFIP are repetitive loss properties — those that have received at least two insurance payouts in excess of $1,000 in a 10-year period.

Even more flood-prone than repetitive loss properties are severe repetitive loss properties. According to the Natural Resources Defense Council (NRDC), more than 36,000 properties across the country fall into this category, signifying that they have flooded multiple times and have received at least four insurance payments of more than $5,000.

In addition to paying homeowners like Fowler to rebuild and recover from damages after a flood, FEMA also administers several hazard mitigation grant programs to assist communities in reducing the risks of future floods. A hazard mitigation is any action taken to alleviate a property’s future flood risk, and includes constructing levees, elevating homes above flood levels, improving drainage systems, and, in more extreme cases, buying out homeowners so they can relocate somewhere safer.

To qualify for hazard mitigation funding, local governments must apply on behalf of homeowners. The process is highly competitive, with counties like Charleston vying for funding against communities across the nation. If a community is denied funding, falls out of compliance with FEMA’s floodplain regulations, or chooses not to pursue grants, people like Fowler are out of luck.

Charleston is divided into several National Flood Insurance Program communities, each responsible for managing its own mitigation projects. The NFIP community of Charleston County, which includes James Island and four other towns but excludes the City of Charleston, reports having 156 repetitive loss properties. Just 10 of these have been mitigated using FEMA funding, according to Kelsey Barlow, a public information officer for the Charleston County government.

Even with properties that suffer severe repetitive loss, few homeowners receive grants to mitigate — that is, correct the underlying problems. As of 2017, just four of 146 severe repetitive loss properties in Charleston County — less than 3 percent — were reported to have been mitigated using FEMA funding. According to the NRDC, the figure is around 30 percent nationwide.

“There have been many additional past attempts from the county to apply for elevation grants on behalf of homeowners, but these applications are not always approved,” said Barlow. She noted that some homeowners fund their own mitigation projects, which are not reflected in FEMA’s data.

Ana Zimmerman, a flood survivor, activist, and professor of biology at the College of Charleston, says the true number of both types of repetitive loss properties in Charleston is much higher than reported. Her home on Shoreham Road flooded many times while she lived there, but she says the city still does not classify it as a repetitive loss property. City of Charleston officials did not respond to requests for comment.

Flood mitigation projects in Charleston are few and far between and often take years to be completed, leaving homeowners subject to more flooding while waiting for their grants to come through.

An increase in flooding as a result of climate change will likely put further strain on a program already stretched paper-thin: The National Flood Insurance Program is in debt to the US government by more than $20 billion, according to the Congressional Research Service. As the program struggles to keep pace with heightened demand for insurance payouts, mitigation funding could become even harder to obtain.

Pushing for Change

After seeing how vulnerable coastal communities are and experiencing a rattling flood event herself, Richardson decided to take matters into her own hands. Last year, she founded Resilient Lands Matter, which works with floodplain communities across coastal South Carolina to encourage investment in green infrastructure and improve land-use planning and flood preparedness.

Richardson advocates for the Community Rating System, which offers discounts on insurance premiums to residents of communities that adopt additional floodplain management practices. Mitigation projects that can easily be done on a community level include educational outreach programs, trash pickups to clear litter from storm drains, and installations of native plants that absorb floodwaters through their extensive root systems.

Richardson said that despite efforts from the city, county, and state, it is becoming increasingly difficult to keep up with rapidly changing climatic conditions. “There are systemic things that are not getting addressed, so we are continuing to exacerbate the problem,” she said. “Our stormwater design standards are woefully inadequate for the changing weather patterns.”

She notes that in just four years of living in the Charleston area, the number of yearly nuisance flood events had increased by more than 30. “We’ve got to stop calling it nuisance flooding and call it chronic,” she said. “I used to walk out to the dock, and I could notice that the low and high tides were getting higher.… It’s absolutely visible to the naked eye that there is more water.”

Home Buyers at Risk

When seeking mitigation funding for his home on James Island, Fowler said relevant information was hard to obtain, and it was difficult to find the right person to speak with. He also feels that the flood history of his home was concealed from him when he was buying it.

“There’s a lot of paperwork involved [in buying a house] — like 100 to 200 pieces of paper — and I was a first-time home buyer,” he said. “I know it is my duty and obligation to read through everything before signing, but nothing about the home’s history of flooding was brought to my attention. Something that significant should be a piece of paper that requires a signature at the bottom.”

South Carolina law requires sellers to disclose their property’s flood history to potential buyers, but, as noted by Fowler, this information is often glossed over during the selling process.

During his ordeal, Fowler discovered that only the current homeowner can ask FEMA for information about a property’s flood history, but he believes those shopping for a home should also have access to this information. “Just like if you wanted to buy a car, you’d want to know if it has been in one accident, seven accidents, or no accidents,” he said. “I think that’s information that should be available.”

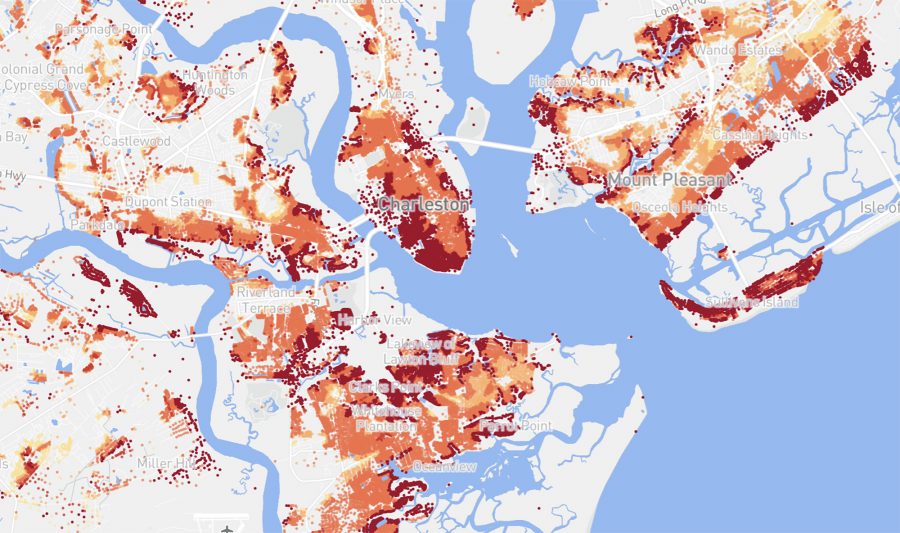

Today, potential homebuyers can use online tools like FloodFactor.com to find out about flood risk, whether in an entire county or at a specific address. According to Flood Factor, 62 percent of properties in Charleston County are at risk of flooding, and this number is projected to increase to 85 percent by 2030. As a result, Charleston County faces a greater flood risk than most other counties nationwide.

As Vulava sees it, the only long-term solution for towns like Charleston is stark: a retreat from the coastline. “Current coastal development is not planning for climate change,” he said. “More work is needed. Too many existing homes within peninsular Charleston are under threat.”