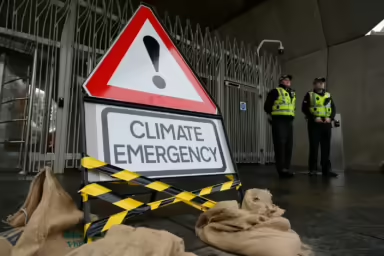

Climate change and resulting weather catastrophes have made anticipating risk increasingly difficult for insurance companies. As they withdraw from various markets, consumers are left with few if any choices to insure their homes.

|

Listen To This Story

|

One of the catchiest jingles on US television, “Like a good neighbor, State Farm is there,” may need a rewrite after the insurance giant announced that, as of Saturday, it would no longer offer home insurance to new customers in California. Existing insurance policies are not affected.

According to a statement the company released on its website, the decision was at least partially motivated by the effects of climate change and “rapidly growing catastrophe exposure.”

The seven largest wildfires in California’s history have all occurred in the past five years and, with global temperatures continuing to go up, there is a good chance that these fires will continue to wreak havoc on the state.

At least that’s what State Farm, the largest home and auto insurer in the US, seems to think.

“We take seriously our responsibility to manage risk,” the company said, adding that it recognizes “the Governor’s administration, legislators, and the California Department of Insurance (CDI) for their wildfire loss mitigation efforts.”

State Farm also cited “historic increases in construction costs outpacing inflation” as well as a “challenging reinsurance market” as reasons for taking this step.

Insurance companies have historically been on the frontlines of anticipating current and future risk. That is, after all, their business.

However, climate change and the weather catastrophes that come with it have made that job much more difficult.

Eric Anderson, the president of Aon PLC, a global insurance and reinsurance provider, told the Senate Budget Committee earlier this year that the uncertainty associated with climate change has created “a crisis of confidence around the ability to predict loss.”

This, Anderson said, has led reinsurance companies, which protect insurance companies from catastrophic losses, to withdraw from certain markets.

“Just as the U.S. economy was overexposed to mortgage risk in 2008, the economy today is overexposed to climate risk,” the executive testified in March.

According to the World Property and Casualty Insurance Report 2022, “economic losses driven by climate change have increased by 250% in the last three decades.”

The report also found that 40 percent of insurers are “ranking climate change as a top priority, with insurability and profitability as leading climate-related issues.”

So, what does this mean for homeowners and businesses in California and other places at high risk of climate change-fueled natural disasters?

It is very likely that their insurance will either get much more expensive, or that they will be stuck paying for damages.

In a report published earlier this year, the reinsurance company Gallagher Re noted that weather events that were intensified by climate change caused direct economic costs of $360 billion in 2022. However, insurance providers only covered about 40 percent of that amount.

The report stated that last year was “another year where climate change, exposure growth and social inflation were the clear primary driving forces of loss,” adding that “the fingerprints of climate change were visible on virtually every major weather and climate event in 2022.”