The Wall Street Journal has disclosed that Lloyd Blankfein was present at the meetings with Tim Geithner and Hank Paulson when the decision was made to bail out AIG, which had sold credit default swaps to Goldman Sachs on which AIG was unable to make good. Goldman’s stock had plummeted to 35, wiping out vast amounts of wealth amongst the Goldman Sachs top echelons, including Blankfein. Goldman Sachs stock is now about 135, nowhere near its peak value, but at least not as bad as it might have been.

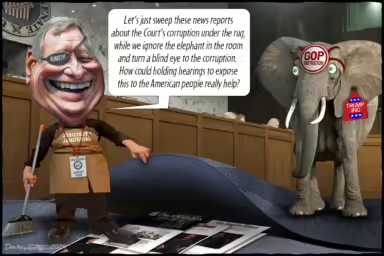

Paulson, who was Secretary of the Treasury at the time, had been CEO of Goldman Sachs, the position currently held by Blankfein. Geithner was head of the New York Fed when the AIG bailout was adopted. He is now Secretary of the Treasury. Grilling Geithner, the House banking committee members failed to bring up Blankfein’s presence at that fateful meeting, either out of ignorance or out of deference to the man who is at the center of the everything and who is a major contributor to the Democratic Party.

Blankfein made over $60 million in 2008, chicken feed compared to the top hedge fund managers who reaped billions — on which they pay a ridiculous low rate of taxes, thanks to Senator Chuck Schumer of New York. But, with the exception of George Soros, also a major backer of the Democrats and liberal causes, most of the hedge fund managers, prefer, like Mafia dons, to remain in the shadows because the more exposure they get, the louder the outcry will be when the fracas over the AIG bonuses is over. Those bonuses amount to about $165 million, a paltry amount that the hedge funds manage get away with.

But Blankfein is another matter entirely. Goldman Sachs is not just a bank holding company. It is a political powerhouse. Robert Rubin, its former CEO, was Clinton’s Secretary of the Treasury. His co-chairman, Steve Friedman, was Bush’s economic advisor and Goldman Sachs high-flyer, Josh Bolten, was Bush’s Chief of Staff. Paulson’s advisor on the TARP bailout was a top Goldman executive and Geithner’s chief advisor is also Goldman Sachs. It is an octopus around the neck of the nation, and Blankfein is its head.

Born poor in Brooklyn, he went to Harvard on a scholarship, and then, to Harvard Law School. After a stint as a Wall Street lawyer, he joined Goldman Sachs as a gold bar and coin salesman. Driven to overcome his roots, this balding banker is seemingly addicted to money. Known to be hysterically funny in private about his own frailties, he nevertheless is, like the Sorcerer’s Apprentice, unable to stop. He is at the epicenter of a culture of pathological greed in which there is never enough money, never enough houses, private jets, expensive clothes and cigars.

Even more disturbing, Blankfein and his ilk continue to function as though it were business as usual, using campaign contributions and lobbyists to grease the wheels of access and power. And as soon as they dislike something, they start shorting the market, engendering panic until the politicians relent. At least Morgan acted out of a sense of duty when he saved the country in 1909 and he wasn’t even that rich. What America has now is a pack of parasites like Blankfein, to whom the country is a bottomless pit they can exploit endlessly.

And while the AIG executives, joined by the Wall Street Journal, proclaim their outrage that Andrew Cuomo wants the names of those who received the bonuses, Hank Greenberg, who ran AIG for decades until he was forced out by Eliot Spitzer, denounces the bonuses as “outrageous,” saying none of them should be paid. Unlike Blankfein, Greenberg appears to have a conscience. Or maybe it’s just that he has lost billions with no way to recoup, unlike Blankfein, who continues to pull the strings of his puppet, Tim Geithner. He has announced that he plans to repay the TARP money, but has said nothing about the billions that were siphoned off to Goldman through AIG as a counterparty. Nor does he say what he has done with that money. The Goldman Sachs fund has lent fortunes to its executives to pay the taxes on their bonuses, which, in total, far exceed those of AIG. One would have thought that this could be the real Marie Antoinette moment.