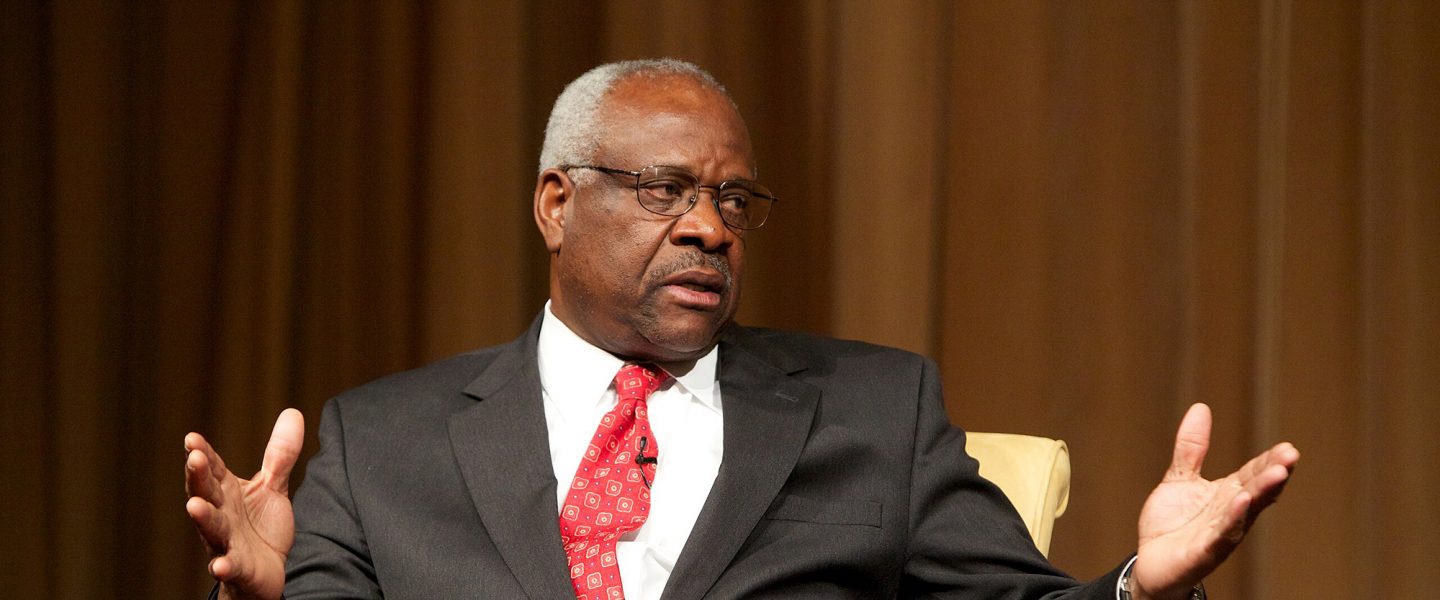

While trying to hide trips he took on the dime of his billionaire friends may not have any consequences so far for Clarence Thomas (apart from exposing his unethical behavior), travel on one of these benefactor’s yachts may constitute a tax-avoidance scheme.

|

Listen To This Story

|

It’s almost comical whenever a news outlet or a US senator finds evidence that Clarence Thomas failed to disclose yet another billionaire-funded trip across the globe. But only almost, because having an ethically-challenged justice on the Supreme Court is a very serious matter.

And, while his lies (by omission) have not had any consequences for Thomas, they could land his wealthy benefactor in hot water (relatively speaking because, generally, rich old guys don’t get in trouble all that much for financial crimes).

On Monday, Senate Finance Committee Chairman Ron Wyden (D-OR) said he had found additional undisclosed trips that were funded by conservative billionaire Harlan Crow and involve travel on private jets.

This not only raises questions about Thomas’s objectivity (to be fair, the justice has never seen a right-wing decision he didn’t like, so one probably wouldn’t have to pay for his lavish vacations to get him to take the most extreme position possible), but also whether Crow is a tax cheat for claiming these trips, including those on his yacht Michaela Rose, are a business expense.

“I am deeply concerned that Mr. Crow may have been showering a public official with extravagant gifts, then writing off those gifts to lower his tax bill,” Wyden wrote in a letter to one of Crow’s attorneys.

The lawmaker added that he is giving the billionaire’s lawyers an opportunity to demonstrate that the holding company for the Michaela Rose “was genuinely engaged in for profit yacht chartering activities and not merely an entity used to write off the cost of the Crow family’s luxurious lifestyle.”

Until now, the senator noted, Crow’s legal team has not addressed whether the billionaire has claimed business tax deductions for trips involving Thomas that his lawyers insisted were for “personal hospitality.”

“On several occasions, I have asked directly how many times Justice Thomas traveled aboard the Michaela Rose and private jets paid for by Mr. Crow, and whether Mr. Crow deducted the costs of these particular trips on tax filings,” Wyden wrote. “These should not be difficult questions to answer.”

The lawmaker also pointed out that he has been unable to determine the full scope of this issue because neither Thomas nor Crow have disclosed all of their joint travels.

For example, Wyden discovered two additional flights in 2010 from Hawaii to New Zealand and back. Thomas, who traveled on Crow’s jet with his wife, did not mention these trips on his disclosure forms.

Then there is the issue of tax evasion.

Wyden says there is plenty of evidence indicating that Crow’s yacht chartering business, Rochelle Charter, was not a business at all.

He pointed out that the billionaire’s lawyers acknowledge that “the Michaela Rose has never been chartered out to any individuals or entities unrelated to Mr. Crow.”

Noting that this is not how a conventional business operates, Wyden raised the possibility that the losses this non-business racked up later helped the billionaire avoid paying millions of dollars in taxes.

“Simply put, a business owner with a genuine profit motive would not operate a business at a loss for more than a decade with no potential for growth and no discernable effort to turn a profit,” the senator wrote.

Wyden, who criticized Crow’s stonewalling on the issue, added that he believes that, based on the information he has been provided, this behavior looks like a tax avoidance or tax evasion scheme.

“This is not a particularly complicated matter,” the senator stated. “Mr. Crow could easily clarify for the Committee whether tax deductions were claimed on superyacht and private jet use by Justice Thomas, but he refuses to do so.”

To clear up the matter, Wyden asked Crow’s lawyer for a series of documents, such as financial statements and charter agreements related to the billionaire’s yacht.

He also included questions regarding whether Thomas ever reimbursed his benefactor for the newly uncovered trips, details of a trip to Russia that the justice took, and information on every occasion he was a guest on the Michaela Rose or used one of Crow’s private planes.