The Next Fiscal Crisis Is Coming to Your Neighborhood

The next fiscal cliff: Impending state/local fiscal crises loom large due to political short-sightedness in budgeting. Urgent action will be needed.

In this week’s WhoWhatWhy podcast, we talk with David Schleicher — author of In a Bad State: Responding to State and Local Budget Crises.

Schleicher is a distinguished professor at Yale Law School and a nationally recognized authority on local government. Our discussion centers on the fiscal challenges that state and local governments are grappling with, particularly in light of the anticipated repercussions of the federal government’s narrowly averted fiscal crisis and the desire of many in Congress to cut even deeper into federal aid to states and cities.

He notes that the past few years have been somewhat of a golden era for state budgets, buoyed by economic growth and substantial federal aid during the COVID-19 pandemic. However, he warns that this period of fiscal prosperity may be ending. As the stream of federal aid starts to dry up and revenue projections take a downward turn, states could be facing significant budget shortfalls.

Schleicher reflects that collective short-sightedness is baked into the state-budgeting process: Politicians, responding to the immediate demands of voters, typically decide to spend now and pass any budget problems on to their successors.

Schleicher further explores the federal government’s role in managing local fiscal crises, the costs associated with infrastructure and transportation, and the potential repercussions of political pressures and inflation concerns leading to cuts in federal aid, which could further exacerbate the strain on state and local budgets.

Schleicher warns of the potential for what’s known as “moral hazard” in federal emergency aid to states and local jurisdictions. If politicians at these levels start to believe that they can always rely on the federal government to bail them out in times of crisis, they may be less motivated to save for emergencies. This dynamic, Schleicher suggests, could intensify future fiscal crises at all levels.

In response to these challenges, Schleicher urges the federal government to take a more proactive role in encouraging states to prepare for emergencies and make sound fiscal decisions. This could involve providing matching funds for state rainy day funds or implementing stricter oversight of state budgeting practices, especially in light of federal contributions.

Schleicher acknowledges that while these policies are economically prudent, they may not be politically feasible. Without robust leadership and a commitment to educating the public about the need for sometimes unpopular decisions, it will be difficult to safeguard the long-term fiscal health of state and local governments.

Apple Podcasts

Apple Podcasts Google Podcasts

Google Podcasts RSS

RSS

Full Text Transcript:

(As a service to our readers, we provide transcripts with our podcasts. We try to ensure that these transcripts do not include errors. However, due to a constraint of resources, we are not always able to proofread them as closely as we would like and hope that you will excuse any errors that slipped through.)

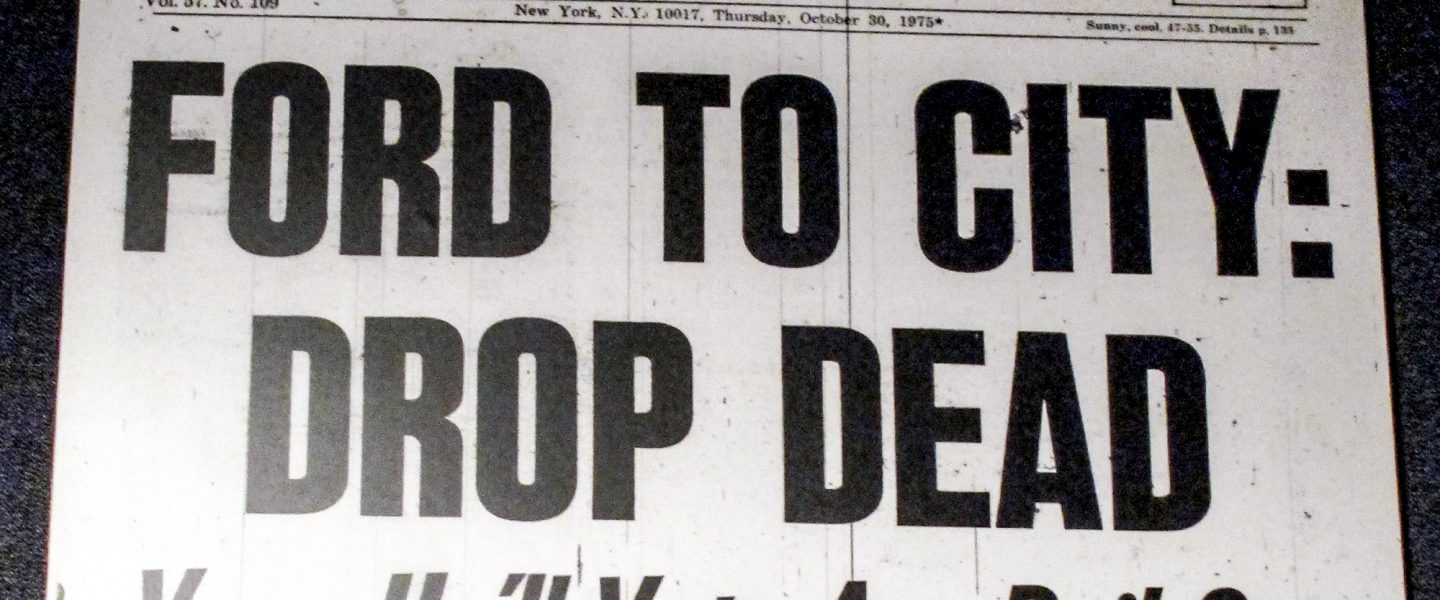

Jeff: Welcome to the WhoWhatWhy Podcast. I’m your host, Jeff Schechtman. The federal government may have averted fiscal disaster, but what about state and local governments that can’t print money, can’t, in most cases, raise their debt ceiling, but often have to rely on the federal government for a handout? If you’re old enough, you might recall a famous 1975 headline in the New York Daily News, “Ford to New York, Drop Dead.” It was a time when New York City was teetering on the edge of a fiscal cliff, while President Ford later claimed that he never actually uttered those words.

The sentiment underscored a reality that still resonates today, the reliance of cities and states on the federal government. Fast forward nearly 50 years, and we find ourselves again grappling with the complexities of state and local finance, urban development, and the role the federal government plays in managing local fiscal crises. To help us navigate these waters, we’re joined today by a leading authority on the subject, my guest, David Schleicher. David is a professor of law at Yale Law School, and his work has been widely published in academic journals.

He’s been lorded as the most important thinker we have on the subject of local government. He’s been praised by the Economist, Slate, Vox, and others for his insightful perspectives. And he is also the co-host of the podcast Digging a Hole, The Legal Theory Podcast. His latest book is In a Bad State: Responding to State and Local Budget Crises, where he provides a comprehensive analysis of the historical and theoretical responses of the federal government to local debt crises. It is my pleasure to welcome David Schleicher here to the WhoWhatWhy Podcast. David, thanks so much for joining us.

David: Thanks so much for having me.

Jeff: Well, it is indeed great to have you here. When we look at the state of the states today, are they in better shape or worse shape than they have been over the past decade or so with respect to their financial condition?

David: The last few years have been, in some ways, the best years in the history of state budgets. The late 2010s were a growing economic time and state budgets are what they call procyclical. State budgets do better when the economy’s bad, and then they have to cut when times are bad. And then COVID hit, and everyone thought there were going to be a lot of crises in state and local governments, but the federal government offered a giant boatload amount of money in addition to the economy never doing as badly as people thought it would. And so the result has been that state budgets have been remarkably flush for the last couple of years, and this has affected the way politics works.

So you see even in liberal states, liberal politicians have been proposing tax cuts. And in conservative states, even conservative politicians have supported raising teachers’ pay. But we’re about to see the worm turn. The federal money is shutting off soon and the revenue projections are getting worse and worse. And so we’re going to see right now how people spent their flush period. That is to say, did they use their flush period to save for the next crisis? Did they use it to address long-run budget problems like underfunded pensions or did they respond to the flush, the one-time federal money to play like the movie Brewster’s Millions, spending it as quickly as they got it?

And we are going to see across jurisdictions that they probably did a variety of things. And so we’re going to see both general cutbacks across all places because the revenue picture is getting worse across states. And then we’re going to see in some jurisdictions, jurisdictions that use the one-time money to create long-run programs, whether it’s tax cuts or new hires are going to be in a real pickle.

Jeff: And in many cases, it does appear that that money was spent by politicians of both political parties because it was in their interest while they had the money to spend it for things people wanted.

David: Absolutely. One of the things that we worry about for people who are in the budgeting game is the time horizon of politicians. Politicians are only responding to the time horizon of voters. And if voters reward politicians who do things that are good, getting more teachers, getting more police, getting more services, cutting taxes, but don’t pay any attention to the long-run costs that creates, then politicians will have an incentive to spend now and let someone else, who’s going to be in office later, worry about later. And that is a structural problem with budgets created by us. That is to say, our lack of attentiveness to the future gives politicians the incentives to spend now and worry about later.

Jeff: And in tough financial times, not only are the states struggling, but the federal government is struggling and under more and more pressure because of politics to spend less.

David: So the federal government doesn’t have to spend less. There are reasons to spend less though. So for two reasons. One is that spending more in a tight labor market leads to inflation, but a second reason is that as you know, many politicians think we ought to spend more. And you’re seeing a lot of federal money is actually granted to states. So a lot of the discretionary federal budget just got cut or projected growth that just got cut in the debt limit deal.

A lot of it actually what the federal government spends is then sent to states to actually spend, states and cities. There’s an old joke that the federal government is a military with an insurance company or an insurance company with a military because they don’t actually do anything really for the most part. And states and cities do almost everything that is important and useful. And so the effect of that is that states and cities that – the cuts at the federal level will harm state and city budgets.

Jeff: What states seem to know, though, is that with respect to any emergency costs, whether it’s from natural disasters, whether it’s infrastructure, whether it is things like the pandemic, that when the chips are down, they can always count on the federal government to bail them out so that there’s less incentive, it seems to put money away for those kind of emergencies.

David: That’s the downside of Federal Emergency Aid, the belief that states will not take their own precautions going forward. We call this moral hazard. Listeners may be familiar with the idea when we thought about this in terms of giving money to banks, it’s the same idea. If you provide money it changes their incentives. Over the course of American history, the federal government has actually taken a varied stance on this issue and has often let states default or force them to make giant cuts rather than offering bailouts. So one, I say well-known, it’s not like Taylor Swift well-known, but it’s know-ish known.

In the 1840s, eight states and a territory defaulted on their debt when the federal government refused to offer aid and people had expected them to offer aid to states, particularly after Alexander Hamilton’s plan to assume state debts. Many of you may be familiar with Hamilton, the rap musical, where they discussed Hamilton’s plan to assume state debt and cabinet battle number one.

The rap battle that takes place between Hamilton and Jefferson is in that musical. We did in fact assume state debts in the post-revolutionary period and when we got to the 1840s, everyone expected the federal government to come do it again. And particularly the British and Dutch investors who had lent money to the states to build canals and do banks and whatever, build state banks. And the federal government decided not to and this reduced moral hazard, but created another problem, which is that it harmed lending to states.

And so you started off with the famous example of “Ford to City: Drop Dead.” Well, that was an example of the federal government, not at least at first offering aid to, in this case, a city, but a very, very large one that was on the edge of default. One irony to that story is that they didn’t do so because they didn’t want to create a moral hazard. But in the end, the federal government after the city went through substantial reforms due to a variety of state laws, the federal government actually did offer aid through something called the Seasonal Financing Act later on. So “Ford to City: Drop Dead” is the dilemma of the stories that Ford said, “Hey, wait a minute.” But the federal government has shifted its position over time, and even over the course of one crisis will shift its position.

Jeff: Is there a difference that we have seen in more contemporary politics between red and blue states and the way the federal government deals with them and the way they deal with the federal government and look to the federal government for money?

David: So it’s interesting. You think of normal times and then crises. So in normal times, blue States, generally speaking, by blue states, I don’t want to say all states that vote for Democrats, but your big Californias and New Yorks and Massachusetts and New Jersey and Connecticut, those types of places send much more money to the federal government than they get in money back. And that’s just because they’re richer for the most part. The reason New York gets much less money from the federal government than it gets back is that it has a lot of rich people who pay a lot of income taxes and not an overwhelming number of old people who get social security or Medicaid, a normal amount. And it doesn’t have a ton of military bases. And so as a structural fact, the New Yorks of the world and Connecticut and particularly New Jersey give an extraordinary amount to the FEDs and get much less back.

In contrast, you see across poorer states and that can be both red and blue poorer states but across the South and New Mexico and a variety of other places, they’re often getting $2 back for every dollar they send in and so that is a huge difference over time. Now, in a crisis, we see there are a few state jurisdictions who are not exclusively blue, but I’d say some of the worst ones are in very extremist debt. So Illinois is the jurisdiction that has the– And just Illinois and Chicago and Cook County and the Chicago school system, a whole variety of related governments have some of the most extreme problems.

And when they ask for money from the federal government, which they did, for instance, the head of the Illinois State Senate asked for a bailout right at the beginning of COVID, one of the responses is like, “Hey, why are you helping Illinois? Illinois is a problem of its own making.” And on one level that’s true, but on another level, it’s less true. And so hypocrisy abounds across red and blue states on this issue.

Jeff: Do you see the problem getting worse?

David: I think the problem of over indebted states and local governments is a long-running American problem. We have 50 states and thousands of local governments. It would be weird if some of them didn’t get into trouble. That’d just be a strange thing. It’s a very large number. They’re not all going to be responsible and there are also going to be economic shocks that push some of them into crisis. And so I think the question is not are politicians worse today? There’s one way I want to get to which they are worse but rather, how can we come up with the structures to make the problems of crises a little less likely or a little less painful when they happen?

And that’s what the federal government should be thinking about. How can we make it so that no state or city ever faces a fiscal crisis? That would be too much to ask. But instead to say, “How can we make this problem a little less bad?” One way though I will say that it is getting worse is that there’s a lot of evidence that voters pay less and less attention to state and local politics. If you ask yourself, a listener, do you know who your state senator or state representative is? Do you know who represents you on the county commission? The answer is almost certainly no.

Do you even know what issues are in front of those bodies? And the answer again, is almost certainly no. And that wouldn’t have always been true across American history. It turns out that voters in state legislative and in local legislative elections now basically just vote for the party they like for president. If you like President Biden, you vote for a Democratic State Legislator, and if you like President Trump, you vote for a Republican County Commissioner. And the effect of that is that it means that less and less of what happens in state legislatures matters to state elections.

And that creates a pretty destructive politics particularly because the people who are paying attention, who get to decide are a very unrepresented slice of the electorate. So it’s rabid primary voters or interest groups who get to give a lot of money. And listening to them structurally leads to more spending and less fiscal rectitude because those groups are usually in what we call intense policy demands. They want something from the government. Who’s going to show up at a weird off-cycle primary election for a county commissioner?

It would be a little weird to do that and at least in contemporary politics and contemporary life, and as a result, it makes sense for politicians to buy these groups off and that makes state and local budgets a lot– Makes them worse over time. And so that’s one way in which things are getting worse. But there have been crises for all of American history.

Jeff: One of the other things that’s adding to that is the hallowing out of local news which is one of the reasons people are less aware of what’s happening in their local communities.

David: Oh, absolutely. There’s a lot of evidence that when a local newspaper closes the cost for the government, governments that are where that newspaper is will face higher borrowing costs immediately. So if they want to borrow money to build a bridge and if you don’t have a local newspaper, it’s going to cost you more. Well, why is that? Well, investors are not stupid and they truly think that governments that aren’t watched by the news media are going to be more wasteful, maybe more corrupt, and certainly less responsive and less on the ball. And so, it’s also the case that we see where newspapers close, we see less split ticket voting.

That is to say, people are much more likely to vote for the same party for president and state legislature in places that don’t have local newspapers. And the nationalization of news. I’ve heard Daniel Hopkins has a wonderful book, The Increasingly United States, that has a huge effect on the nationalization of politics. And again, that’s in part due to the internet and the decline of the ad revenue for local budgets. But also a big result is responding to demand, which is that people are often quite more interested in following whatever Donald Trump tweeted than the things that have a more direct effect in their life. And so, the decline of local media is both pushed by structural work but also pulled by our interests.

Jeff: The other factor that enters into this, we’ve been talking about it on the spend side is the revenue side and greater and greater demand for less taxes. California perhaps being the penultimate example going all the way back to Prop 13.

David: No, the voters often demand from states impossible things. They want more services and less taxes. And it’s a challenge for governments to come up with a way of convincing voters that it’s worth it to pay taxes for the things they get. And not wanting to pay taxes is a totally normal thing. Who wants to pay taxes? Everyone wants to get free stuff. That’s normal but it is the case that it doesn’t work in the medium run or even in the short run. And so the lack of constitutional or better constitutional rules that force this longer-run thinking plays into our weakness as voters and influence politicians.

Jeff: You’ve indicated that you thought that the amount of money that the federal government put out there during the COVID crisis could have been a unique opportunity for the federal government to deal with states, talk about that.

David: Yes. So the federal government gave a lot of money to states and this gave them a lot of leverage. Some states really needed the money. Other states needed it less. The amounts were probably too much in the end but it gave them a lot of leverage. And I think one of the tragedies of the federal money was not that they gave money because again, it would probably be too much to ask states to plan for a global pandemic or cities. It’s a lot to ask. But the federal government could have used conditions on that federal money to encourage more responsible budgeting going forward. And so here’s an example.

States generally budget on what we call a cash basis. And what does that mean? It means they count dollars in dollars out each year but this means that if you create a liability that will hurt you in future years, it doesn’t count against whether you have a balanced budget this year. So if you underfund your pensions this year or fail to do maintenance on a road or engage in a tricky transaction that’s going to have a cost in the future, it doesn’t affect whether you’ve balanced your budget this year. Other entities that budget don’t behave this way because they understand that robbing Peter to pay Paul is a bad idea. The engagement we call accrual accounting.

The federal government could have created conditions on federal money to encourage states to budget in a more responsible manner. In fact, they still could. It would be a little harder because they have a little less leverage but they could condition on certain federal tax benefits that are given to state and local debt in order to achieve this. The states have reasons not to do this. As we mentioned, politicians are worried about solving the problem today but the federal politicians had a chance to really encourage a more responsible state budgeting going forward and they [unintelligible 00:19:12]

Jeff: Do you sense that most state legislatures out there are doing the responsible thing in terms of budgeting or is it really just about giving free stuff to the voters?

David: It’s a mix. I have a lot of respect for state politicians. It’s a very hard job. State legislators particularly are often– It’s a part-time job. They’re underpaid. They’re understaffed. It’s a really hard job and I think that most politicians are trying to do the right thing. Again, I don’t want to– I’m not a cynic about this stuff but it is a hard thing to do given voter demand for stuff. And I think what you’ve seen in the last couple of years is just really varied outcomes. So one that I’m very positive on is the State of Connecticut, for most of the second half of the 20th century, is one of our big budget basket cases. They didn’t save at all for their pensions for many, many years. They created an income tax and then spent the money and it was a big problem, but in the last five years, they’ve really turned things around. They imposed some innovative legal limits that I think that the federal government should have encouraged other states to adopt, which is something we call bond lock and volatility caps, details of which I can talk about if you’re interested.

But the result has been that after years and years of either saving just enough, making just enough to make their annual pension payments and not having enough in their rainy day fund or just the kind of a savings account. During the pandemic when they got this big flow of money, they really saved a lot of it. And so that’s like a really positive story. Other jurisdictions, I think you see less. That’s less so. And so that may be part of due to the politics of the state, but it may just be that the politicians in the state are taking a healthfully-long view in Connecticut in contrast with some other places.

Jeff: One of the things we see around the country, and certainly California as an example, and many other states as well, you mentioned pensions before, is these huge amounts of unfunded liabilities.

David: Yes. So I think people misunderstand a little bit what obligate debt pension underfunding is. So people often think of pension underfunding as something that’s exclusively a problem about the size of pensions, but there are some jurisdictions that have very, very expensive pensions that say workers get good pensions, but they’re perfectly funded because the voters have decided or the politicians have decided to tax themselves to fund it.

And so what is pension underfunding? Well, it’s just a form of debt. It’s just a form of borrowing in the sense that you have to make the payments. You’re consciously required to make the payments just like you’ve borrowed money but one of the things about the way that most states work is they’ve a limit. If they want to issue bonds, let’s say to borrow money directly, that you often have to go directly to the voters or they have a cap on the amount of bonds they can issue each year and they have to keep a balanced budget.

The pensions are treated off books. That is to say, if you underfund your pensions or you imagine you’re going to get a giant return on the money you’ve invested in your pension, it doesn’t count against your bond limit or whatever. And the legal rules result in jurisdictions channeling their desire to run deficits into pension underfunding. And this is, in a lot of ways, a total tragedy the way that legal rules create these incentives for politicians because states can only borrow so much limited by the market as well as limited by their laws.

And one of the things that you saw, particularly at the post-Great Recession period is that states should have been borrowing quite a lot to build stuff. Interest rates were low, unemployment was high. That’s the time when you want to build giant new infrastructural marvels. Your new Brooklyn bridges. Your new aqueduct systems. And look back at where you live, in that period, did we do that? And the answer is we didn’t. And it was because instead of using our borrowing capacity to build stuff, we used our borrowing capacity to hide deficits, our annual operating deficits. And the way we hid it was through underfunding our pension system.

Jeff: Then the federal government came along once again with what has become a de facto bailout with respect to infrastructure and the building of these projects now.

David: So the federal government added a lot of new money in the form of infrastructure, but even the federal government, people misunderstand what’s going on with infrastructure. Infrastructure is at all times. There’s some very, very few exceptions largely funded by states and cities, not by the federal government. The federal government can increase the amount of money it spends mostly in grants to states. But particularly when you take into consideration operations and maintenance in addition to that capital costs, the states and cities do most infrastructure spending.

And just think about it for a minute: what is infrastructure, what is road infrastructure? You may think of the interstate highway, but most roads are the roads that lead to the interstate highways. They’re the roads that go through your town, they’re state roads, whatever it is. And those are built by states and cities. And so the federal government can increase money for infrastructure.

One of the ironies of this period that’s coming up, as I noted that budgets are getting worse, is that much of the federal effort to increase investment in infrastructures, not just roads and bridges and airports, but also things like green energy transition issues, which also require a lot of infrastructure investment. The federal government’s going to be pushing more money in, but the states having these revenue problems are going to start pulling money out. And so states are going to frustrate some of the goals of the Biden administration.

There’s federal laws that attempt to deal with this, what they call maintenance of effort rules or matching funds. A whole variety of ways the federal government tried to encourage states and cities to keep spending but given that they’re doing most of the infrastructure spending and they’re facing revenue losses, they’re going to pull back. And in this way, as you note, the federal spending will help them reduce their problems, but it will also come at the cost of frustrating some of the federal government’s infrastructural goals.

Jeff: And, of course, it’s during a period right now where the borrowing costs, if they had to do that, would be so much higher.

David: Oh, yes. This is again, part of the tragedy of the post-Great Recession period. Getting it was theoretically good for a huge amount of investment. Now states and cities are going to have to borrow at higher rates to build. And so there is going to be even less incentive to invest. Now, this may suggest even greater federal investments. The federal government has lower borrowing costs than anybody. But I think that if you are sitting around waiting for the great infrastructural investments in your town that you missed out on in the early 2010s, I wouldn’t hold my breath. There’ll be some due to the new federal spending, but it’s not going to be a period like say the turn of the 1900s, which was the great period of American infrastructure development.

Jeff: And the broader economy and the possibility that we’re on the precipice of a recession is going to add to all of these problems.

David: Yes. I think that in some ways, the two things I had to say about that, one is that the declines that we’re seeing in state revenue are a forward signal of declining incomes. That’s what a recession is on some level. We have a weird economy right now where unemployment is at record lows but we’re seeing other types of problems. And so like everyone else hope that it doesn’t tip over and that we can keep going, keep the economy at least not landing hard, but there’s obviously risks there.

The other thing is that declining state revenue is one of the things that makes little recessions into very bad recessions. So in the Great Recession, what we saw was that after the federal government stopped giving money to states, states had to pull back really, really, really hard. And the decline in employment that was created meant that was one of the big reasons why the Great Recession lasted so long. Private-sector employment goes back to the pre-recession period many years before public-sector employment does. And so one of the things we’re going to see in these coming state cutbacks is something that is going to drag the economy.

Jeff: The other question in all of this is the degree to which all of the states have different revenue sources that they rely on, some property tax, some sales tax, some income tax. Talk about that.

David: So you see states have a widely varied set of revenues. And you could think about this in a couple of ways. One is that states and cities, especially you see this more in your blue states, have increasingly relied on income taxes and capital gains taxes. And that has a real problem if states aren’t saving in good times because those revenues are particularly volatile in contrast with sales and property taxes, which are traditionally more stable.

Another thing is that because the sources of revenue were varied and because we have so many local governments, we have particular governments that are going to face particular problems. And so the two types of governments that people are most worried about, one are transit agencies. So transit agencies get a substantial amount of their revenue from, we call the farebox, but just the tolls you pay to get onto the train or bus. With work-from-home, those governments are getting less and less revenue. And this is going to mean they either need to cut back or they need much more state funding. And you’re starting to see these fights in a variety of places. And of course, cutbacks are bad for state politicians and other goals like not having too much greenhouse gasses.

The other type of government that’s going to face real problems are downtowns that have seen, again, for the same work-from-home reasons, see real decline in commercial property values. And then jurisdictions are often very highly reliant on commercial property taxes. That is to say the taxes they get from downtown office buildings. And if those are worth less over time and they’re usually taxed at a higher rate than residential property because office buildings don’t vote, this is going to put some real fiscal pressure on downtown centers. Those two are the types of government that we’re probably most worried about. In contrast, other types of revenues are still quite strong. Sales revenue, tax revenue has been pretty strong for the last couple of years as people have continued to buy lots of stuff.

Jeff: As you say, sales tax is strong, employment numbers are still good in terms of that part of tax revenue and property values are holding steady.

David: Yes, absolutely. Again, so much of what happens with the revenue picture, particularly for some states, is due to the high-end income taxes. The very, very rich pay a lot more than others. Progressive tax systems, that’s how they work. On one hand unemployment, on the other hand, for instance, during the COVID, the fact that the stock market did so well was one of the reasons why states didn’t have such as big-budget holds as we thought, which then when the federal government added so much money was why their budgets have been so strong for the last couple of years.

Jeff: Are you optimistic or pessimistic about the situation over the next four to eight years?

David: It’s a great question. I guess I’d say that I think there’s going to be some really varied outcomes. That this huge boom should have created lots and lots of opportunities to save for a rainy day. I think many jurisdictions did that. On the other hand, I think some jurisdictions did not. I don’t think this is going to look like the Great Depression type of problems or anything like that. I don’t think the economy is going to look like that, but I do think we’re going to see a number of real localized crises.

Jeff: And in any particular place or region?

David: Yes. My business is understanding the broad law and policy, not what they call credit analysis, where I’m picking out of this jurisdiction, so I’m loath to give investment advice in this way. But I will say that the places that the types of governments that we should be most worried about are the transit agencies, the big commercial– Downtown there’s lots of commercial property taxes, and then the places that have come into it with the most debt. And if you want to look at the places that have come into the most debt, you’re looking at your Illinois and New Jersey’s of the world. And then particularly your Chicago’s, and a few other jurisdictions.

And so those are the jurisdictions that people are generally worried about. I’m not telling you to not buy initial bonds anywhere. This is not investment advice, but I do think that the old Warren Buffett line, which is when the tide comes in, we can see who’s swimming with no underwear. We’re going to find out.

Jeff: And of course, just to put a cap on it, California has been interesting, given that it had these huge surpluses and now is facing potential deficits.

David: California, obviously, is in many ways, it’s like a giant country, except that it can’t print money. And so what happens in California, it’s obviously much more important than what happens in anything because it’s just so much bigger. California, obviously, has this huge deficit. One thing I’ll say is that places like California, and this is to a lesser extent true for some cities like New York, or not as true for New York City, are in their own way sitting on this giant gold mine, but they’re refusing to tap it. And so people want to live in California.

You can tell because the property values are so high. And if California would really, really uncork housing development, you’d see a huge flow in that would help stance some of these going deficits coming forward. That would require running over a lot of the opposition to new housing construction. If you want me to be optimistic, I’ll be happy, which is that one of the hopes is that pressure can force political change of things that felt that were immovable. And so one of the things I’m hoping for is that in jurisdictions that face real fiscal pressure, they are forced to do things that would have made sense in other times as well like allowing more housing construction.

Jeff: David Schleicher, his book is In a Bad State: Responding to State and Local Budget Crisis. David, I thank you so very much for spending time with us here on the WhoWhatWhy podcast.

David: This was really, really, really fun. Thank you.

Jeff: Thank you and thank you for listening and joining us here on the WhoWhatWhy podcast. I hope you join us next week for another radio WhoWhatWhy podcast. I’m Jeff Schechtman. If you like this podcast, please feel free to share and help others find it by rating and reviewing it on iTunes. You can also support this podcast and all the work we do by going to whowhatwhy.org/donate.