Martin Sheil, a former IRS investigator, walks us through what we know about Trump’s taxes.

Over the past two years, Americans have been subjected to a crash course in government and its discontents: from separation of powers and obstruction of justice to the fine points of collusion vs. conspiracy. Now, to understand last week’s New York Times report on President Donald Trump’s taxes, they need a new class: Commercial Real Estate, Finance, and Taxation 101.

Teaching that subject in this week’s WhoWhatWhy podcast is Martin Sheil, retired branch chief of the IRS criminal investigation division and contributor to WhoWhatWhy.

Sheil gives us some insights into what the IRS calls “badges of fraud.” He discusses why some “cheating” can be legitimate while other kinds are not. Hint: It’s all about intent. Sheil also talks about the relationship between tax returns and financial statements, why banks didn’t take Trump’s financial statements seriously, and what kind of hidden revenue streams he might have had.

He then explains why money laundering, something almost endemic in luxury residential real estate, is still going on today.

In the end, Sheil reminds us that there is no Office of Legal Counsel opinion that provides Trump or any president with a free pass from paying his or her taxes.

Click HERE to Download Mp3

Full Text Transcript:

As a service to our readers, we provide transcripts with our podcasts. We try to ensure that these transcripts do not include errors. However, due to time constraints, we are not always able to proofread them as closely as we would like. Should you spot any errors, we’d be grateful if you would notify us. Related front page panorama photo credit: Adapted by WhoWhatWhy from 401(K) 2012 / Flickr (CC BY-SA 2.0) and The White House / Flickr.

| Jeff Schechtman: | Welcome to the Radio WhoWhatWhy Podcast. I’m your host, Jeff Schechtman. Think about the legal education we’ve all gotten recently, things we know today that we didn’t have a clue about two years ago. On the plus side, many of us better understand the Constitution, the rule of law, the rules of impeachment, and the separation of powers. Did you ever know about the Logan Act, about conspiracy versus collusion, about counterintelligence versus criminal investigation, about what really constitutes obstruction of justice? It’s all been like living in a John Grisham novel. |

| Jeff Schechtman: | Thanks in part to the press and dozens of retired US attorneys appearing on television, we all understand aspects of the law that we didn’t have to go to law school to understand. Now, a new arena has entered our Trump-era vocabulary. In the New York Times story last week about Trump’s cash and tax losses, we’ve now entered the realm of learning about the world of commercial real estate and its dizzying complexity. As we go through the looking glass, we will certainly learn more about Trump and his taxes, but we’ll also learn about carry-forward losses, badges of fraud, LLCs, and a whole new vocabulary with respect to finance and taxation. |

| Jeff Schechtman: | I’m joined in this week’s WhoWhatWhy podcast by Martin Sheil. Martin’s a retired branch chief of the IRS criminal investigation division, a former contributor to WhoWhatWhy, and he joins me to talk not just about Trump’s taxes but about the whole backdrop of commercial real estate taxation, both legal and illegal. Martin Sheil, thanks so much for joining us. |

| Martin Sheil: | Well thank you, Jeff. Thanks a lot. |

| Jeff Schechtman: | One of the things that I don’t think people fully understand, to sort of kick this off, is that, in that New York Times story last week, it wasn’t the tax returns per se that The New York Times had access to but in fact transcripts. Explain, first of all, what that is, what it is that we got a glimpse of. |

| Martin Sheil: | The New York Times article of May 7th documented approximately a $1.2 billion loss by Donald Trump over a 10-year period. Yet, these losses didn’t come from the tax returns themselves. The reporters didn’t actually have possession of Donald Trump’s personal form 1040s. What they used were transcripts of those returns. The IRS has the ability to computer-generate transcripts that are line-by-line essentially a copy of the numbers enumerated on the tax returns, but these transcripts — they’re called IDRS transcripts — they don’t include the underlying schedules that might explain or at least clarify a little bit as to where The New York Times reporters came up with these big losses that… The New York Times reporters just basically have bottom line numbers. They don’t have any supporting documentation for these losses, and to really fully understand where they come from, you need those schedules. More than that, you need the underlying accounting work papers and files and notes, et cetera to fully understand that. |

| Jeff Schechtman: | Even from the numbers that were there, Martin, is there any reason to think that fraud was somehow involved with this? |

| Martin Sheil: | You would think, just the average Joe would think that “Well there must be fraud involved here to have over a billion dollars in losses over 10 years,” but the way the tax code works and particularly the way it’s slanted in favor of some of the special interests like the real estate industry, that it’s not uncommon for major players in commercial real estate to generate these types of losses. My interest is in Mr. Trump’s potential for committing financial frauds. To understand that, at least from the perspective of criminal investigator like myself, we have to talk a little bit about the difference between a civil assessment that comes from a tax audit and a potential criminal prosecution for tax fraud that could ultimately land the target in jail. |

| Jeff Schechtman: | Is there a way to ascertain whether fraud had been committed from the top line numbers, from the numbers that The New York Times had that you were talking about a moment ago? Could that top sheet, could those transcripts give us an insight into any kind of fraud or do we need more material to understand that? |

| Martin Sheil: | Oh, no. The transcripts are just there to reflect numbers. That doesn’t tell you anything about what the intent of the taxpayer was in terms of how they structured the tax return and what their objective, their purpose was. I think those New York Times reporters did a wonderful job in documenting the immense losses, but they did not pin down badges of fraud, the intent necessary for a prosecutor to actually prosecute for potential tax fraud. These same reporters though have done a wonderful job in a previous New York Times article. They honed in on a gift tax evasion fraud scheme perpetrated by the father of Donald Trump, and this scheme was actively aided and abetted by Donald Trump. It really demonstrated a predisposition on Donald Trump’s part to commit financial fraud. |

| Jeff Schechtman: | The other part of this that I’d like you to touch on is the difference, because people talk about fraud with respect to taxes, is that there’s civil fraud and criminal fraud, and also talk a little bit about the difference between the two as it relates to what we know so far. |

| Martin Sheil: | What I like to do is talk about the badges of fraud which there’s many. These have been yielded by various fraud prosecutions that are going to court and the court basically has determined what exactly is a badge of fraud. When we talk about badges of fraud and the differences between fraud and, say, a civil tax assessment from an audit, we really are talking about how the government must document evidence of willful intent. What was in the mind, in the head of the taxpayer when returns were filed? The evidence of this corrupt intent or this evil intent usually displays itself through such badges of fraud as the use of shell companies to conceal financial improprieties, use of fictitious invoice scheme used to disguise or misrepresent financial activities. Sometimes some folks use a double set of books or even three or four sets of books of records depending upon their situation. Then there’s the falsifying of financial statements. |

| Martin Sheil: | Each of these instances would reflect an overt act made by the taxpayer and/or his accomplices to intentionally, purposely falsify entries on the tax returns to mislead anyone who looks at it. Sometimes when some folks get audited, they get hit with a big tax assessment, sometimes even a penalty because they misunderstood the law or they made an arithmetic error or there was just some sort of oversight. There was a change in the law that they didn’t catch and they just kept doing the same thing year after year. Well that’s accidental. That’s not purposeful. It’s not willful. That’s the difference. |

| Martin Sheil: | The difference between civil fraud and criminal fraud is essentially civil fraud, you can get hit with a monetary penalty of up to about 70% of the tax deficient and that’s a pretty big hit if you’re talking in the millions of dollars, whereas a criminal fraud, you’re looking at going to jail as well as getting hit with all the monetary penalties. |

| Jeff Schechtman: | What is the difference between an individual having this civil and/or criminal liability and a corporation having that liability? |

| Martin Sheil: | Obviously the corporation will not be going to jail, but certain people can be held responsible for the filing of, say, a false corporate tax return. A possibly of the Trump Organization corporate return having been falsified and a number of people may well have been involved in conspiring to falsify that return and/or aiding and abetting, and those folks may well have some criminal culpability and may well end up being prosecuted for conspiring to impede or obstruct, impair the IRS from ascertaining the correct amount of tax due and owing. They could be looking at potential jail. |

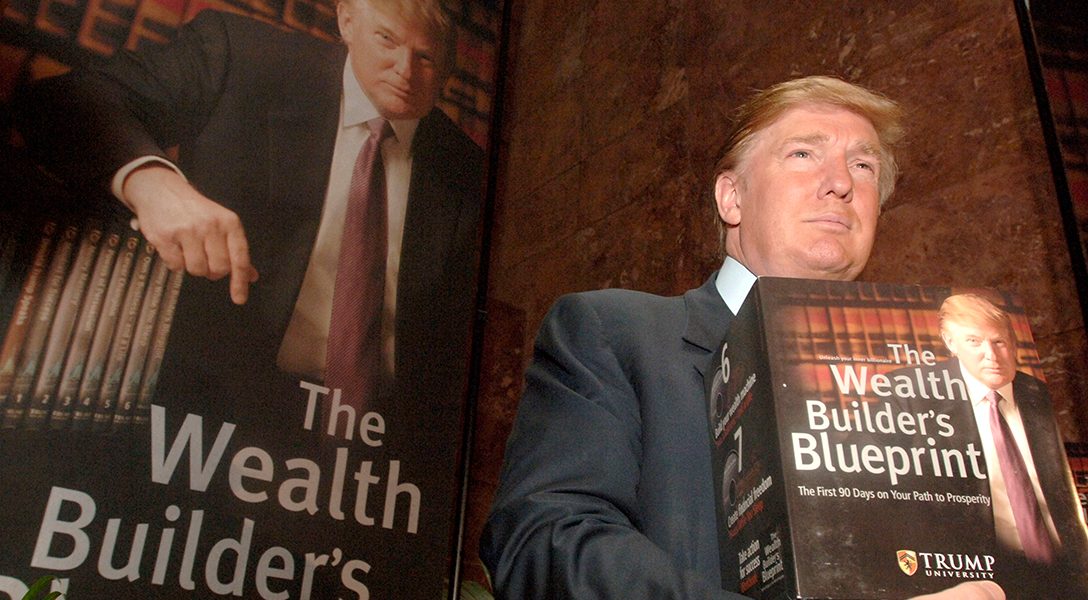

| Martin Sheil: | I think I mentioned earlier that where did Donald Trump get his, derive his attitude about the government and about the IRS and taxes. I think The New York Times really pinned it down in their earlier article when they referenced the Fred Trump, Donald’s father, involvement in the gift tax evasion where, back in the ’90s, Fred Trump instigated a fraud where he created a shell company called All County Maintenance, and then used this shell company as a conduit to essentially funnel most of his wealth, a large portion of his wealth to Donald Trump. We’re talking about multi-millions of dollars. He did this intentionally evading gift tax assessment in the millions of dollars. |

| Martin Sheil: | The way they made this happen was through a false invoicing scheme where the shell company was invoiced for millions of dollars for boilers or refrigeration equipment that simply didn’t exist or they inflated the cost of the boiler or the refrigerators hundred-fold, and then the difference between the actual cost and the markup ended up in Donald Trump’s pocket. So multi-millions of dollars were transferred by Fred Trump to Donald Trump using this shell company in a false invoicing scheme. |

| Martin Sheil: | Well here you have badges of fraud. You have overt acts, the use of a shell company, the use of a false invoicing scheme to conceal the funneling or the transfer of wealth from Fred Trump to Donald Trump. This is not accidental. It’s not an oversight or an arithmetic error. This was purposeful, willful. Unfortunately, the IRS did not catch it. They don’t catch everything, and the statute of limitations has passed and Donald Trump has … When you wonder where Donald Trump got his money to invest in casinos and hotels and stuff, but also I think Donald Trump’s attitude towards the government and towards the IRS was also transferred from his father. |

| Jeff Schechtman: | I want to talk a little bit about these losses that were reported because there seems to be two parallel schools of thought on this. You hear a lot of people talking about the fact that these were normal losses that people in the real estate business and carry-forward losses, the normal kinds of things that people did on their taxes particularly back in those days. The other part of it is that a lot of these losses were not just tax losses, but they were losses of cash, in many cases money that came from banks through sometimes fraudulent means. Talk about that please. |

| Martin Sheil: | I look at it from, tax law from the point of view of the honest law-abiding, tax-paying citizen. When you first start off setting up a business, a small business, it can be tough. You can incur losses for some time before things turn around and you start making a profit. The government recognizes that and wanted to assist small businessmen and big businesses too in terms of being able to absorb losses and not bankrupt the company but allow them to hang in there until some things can change. Now, in doing that, they legislated some tax benefits which I guess we can refer to as allowing folks to take what’s known as a net operating loss, the acronym being NOL, and sometimes allowing the business to either carry back or carry forward some of these losses to apply against income from other sources and whatnot so that the business wasn’t being penalized twice, first from the shock of some sort of economic recession or something that is negatively impacting their business and then having to pay tax on top of that. |

| Martin Sheil: | So government was trying to help business out. Now, some will complain and point out that special interests sort of took over and had an undue influence over the tax legislators and provided some special type of benefits to certain industries, and that certainly is point well taken and it’s arguable. Certainly real estate has benefited a lot from the House Ways and Means Committee legislating special deductions and losses for the real estate industry. |

| Martin Sheil: | But having said that, going back to that $1.2 billion in losses over a 10-year period, understand that in commercial real estate, these businessmen invest as little of their own money as possible and in almost every instance will attempt to convince or persuade big banks to provide financing. They will pitch them a deal where they will suggest to the banks that this is going to be a joint profit-making, money-making venture and assure the banks that their loans will be repaid with interest, lots of interest so that the banks then see it as a profit-making venture. So what happens then, particularly with businessmen like Donald Trump who’s … Let’s face it. He’s a salesman. He’s a little bit of a huckster, some would say a conman. He will persuade and he did persuade banks for years to lend him multi-millions of dollars for investment in commercial real estate, whether it was office buildings or hotels or apartment buildings, wherein he would sell luxury condominiums. |

| Martin Sheil: | Trump kept losing money on all these ventures. He just was not a good businessman. He declared bankruptcy something like six times with his casinos, which that’s pretty hard to do considering the cash flow of a casino, but it happened. The banks somehow were persuaded by Donald Trump to continue to invest in Donald Trump’s ventures. One of the ways Mr. Trump did this was by providing the banks with these financial statements which were just false. It was the only way to put it. Michael Cohen famously talked in his congressional testimony that Donald Trump inflated the assets on his financial statements to Deutsche Bank when he was looking to buy the NFL franchise, the Buffalo Bills. He inflated his assets by something like $4 billion in almost a ludicrous fashion when, from one year to the next, his financial assets went up by $4 billion and Trump attributed this increase to the branding value of the Trump name. He had no other evidence to support this. That should have been, the bankers should have just pretty much laughed at that as opposed to giving that serious consideration, but this is what he does. |

| Jeff Schechtman: | What is the nexus from a legal point of view, an accounting point of view, between false documents that one might give to a bank in order to secure a loan as he did with Deutsche Bank and the actual reporting that goes on to the IRS? Is there a nexus between the two? Is there any reason the two should be consistent? |

| Martin Sheil: | Well, there should be a nexus. Most businessmen, honest businessmen, will maintain one set of books and records, one set of financial statements and documents, whether it’s for the banks or whether it’s for the IRS or whether it’s for some other taxing authority such as property tax, those New York City finance departments. Yet, it appears that Donald Trump makes use of more than one set of books and records or more than, certainly more than one set of financial statements. It depends on the situation. That $1.2 billion of losses that Times reported Trump incurred over a 10-year period, an awful lot of that $1.2 billion was not Donald Trump’s money. It was actually the bank’s money. |

| Martin Sheil: | Donald Trump had hoodwinked the banks into providing him these millions and millions of dollars which Trump would then lose, but because of the way the tax law is set up and the use of limited liability companies and flow-throughs and partnerships and subchapter S corporations, Trump could actually claim much greater losses than what he personally lost out of his own pocket. |

| Jeff Schechtman: | Why would the banks not want to see his tax returns? |

| Martin Sheil: | In fact, most banks do insist on seeing tax returns when … If you or I went into a bank and asked for a loan to start up a business or to buy a house or rental property, something like that, most banks would insist on “Let’s see your last couple of years of tax returns.” That’s part of the record, part of the loan record. Yet, because of the way the tax law is, many commercial real estate folks are able to generate negative income or through net operating losses, through depreciation, through investment credits and special types of tax allowances. |

| Martin Sheil: | So the banks probably are not too unimpressed by big businessmen showing a lot of losses. They’re more interested in seeing actual financial statements because the bank will always be looking to “Well what happened …” They’ll asked them “What happens if this venture goes south? Can we get back our money that we’ve lent? Is there some collateral, some asset that we can go after to make ourselves whole?” So then what they should do if they’re doing their due diligence when making a loan is to scrutinize the financial statements provided them by Donald Trump and his accountants and make sure that those assets are true in terms of their value. |

| Martin Sheil: | Unfortunately in the ’80s and ’90s particularly, it appears that the banks either did not do their due diligence or the whole thing was a wink and a nod. They just wanted to be in business with a famous businessman or they felt that they could make up their losses in some other fashion. I can’t really answer for the bank. I really hold them responsible for over and over providing money to a businessman who’s just a big loser, who’s just losing money in venture after venture. There’s no basis for continuing to loan him money. |

| Jeff Schechtman: | If you listen to all of this and understand all that we’ve been talking about, it seems like this is the most fertile ground imaginable for money laundering. Talk about that. |

| Martin Sheil: | Well yeah. It’s been well-known for years that commercial real estate and particularly the selling of luxury condominiums in big cities such as New York or Miami or LA would provide a vehicle for folks who wanted to launder their money from some ill-gotten gains whether it was racketeering, Russian organized crime, or South American narcotics traffickers or any type of gambling or loan sharking. What was big back in the ’80s and ’90s was, when the Russians came in, fuel excise tax fraud. You can’t believe the amount of money involved in scamming the excise tax on when you tank up your car or your truck. There’s excise tax on every one of them. You don’t pay that excise tax, you can make a lot of money. Some of the Russian mobsters and Italian organized crime was also involved in this, and they made a whole bunch of money. |

| Martin Sheil: | The reason I mention that is because there’s some famous characters that are Russian-based that bought dozens of condos in Trump Tower in Manhattan as well as in Miami. They would pay, frequently they would pay with cash. So here you have, say, a Russian mobster selling drugs or skimming fuel excise tax fraud or whatever, who is flush with money from some sort of crime, is looking to clean that up, and says “Well, what can I do?” Well buying a luxury condo in Trump Tower for cash using a shell company, thereby guaranteeing anonymity, well there wasn’t a better money laundering deal anywhere. |

| Martin Sheil: | So when folks talk about offshore and Switzerland and whatnot as places that launder money, in the last couple of decades, few decades, really the old USA, particularly the big cities, particularly residential and commercial real estate was the place to go to launder large amounts of money because of the way the law is set up that there was no insistence on knowing the ultimate beneficial owner of a shell corporation that would purchase these condos in Trump Tower. The cash would come from some anonymous person through a shell company, end up in an escrow account of an attorney in New York City, and then that money would go over to, say, the Trump Organization or more likely to one of Trump’s shell companies. In fact, who knows? Maybe it didn’t even go there. Maybe it went into some other offshore accounts and was never reported. |

| Martin Sheil: | So what you have when you’re selling luxury condos in New York City for multi-millions of dollars through the use of shell companies was really just a lack of accountability. So it made for an ideal way or mechanism to launder lots of money. |

| Jeff Schechtman: | There’s been a lot of talk about the 50-something million dollars in interest that showed up on one of these returns- |

| Martin Sheil: | Right. |

| Jeff Schechtman: | … and where that came from. |

| Martin Sheil: | Right. |

| Jeff Schechtman: | The assumption has been that somehow that was connected to money laundering. What is your take on that? |

| Martin Sheil: | Because we only have little bits and pieces, it certainly lends itself to speculation. I always say let’s break it down. Break it down into bite-sized pieces so we can understand it some more. As I understand, I think it was ’90 or ’91 that Donald Trump suddenly reports, let’s say, 51 or maybe it was 53 million dollars in interest income, where in prior years, there’s no record of anywhere near that type of interest income being reported. So suddenly, he came into a lot of money. Now, this is right in the middle of the period of time where the Times said that, over a 10-year period, Donald Trump had lost $1.2 billion. |

| Martin Sheil: | So okay. Let’s think. How do you make $51 million or $53 million? I would suggest it’d have to come from a bond, but that’s unlikely. The most likely source of income … And these transcripts do not show the schedules so we don’t know, so right now I am speculating, but it’s kind of an informed speculative opinion here that the likely source of the 51, 53 million dollars interest was likely a large loan that Donald Trump made to another individual or to a business or to a consortium. When you break it down, I don’t recall what the interest rates were back in ’90, ’91, but just for your listeners’ ease of mind, let’s use large rounded numbers here. I would suggest to you that an interest rate of 10%, maybe 10% and change of a half a billion dollar loan, that’s $500 million, that would come to about 51 to 53 million dollars in interest. |

| Martin Sheil: | So this is Donald Trump being a lender, lending out a half a billion dollars and getting $51 million interest. That flies in the face of everything we know about Donald Trump. I mean Donald Trump is a borrower. He’s not a lender. Donald Trump is a taker. He’s not a giver. So yeah, there’s a possibility that Donald Trump received a large sum of money from someone else, decided to sit on it for a year or two, and made use of it and then it disappeared. We don’t know. There was no indication of that same size amount of interest in the following years. Yeah, if you want to speculate, yeah, sure, it’s possible that this could come, that $500 million came from some illicit source, but I don’t really know. Donald Trump has got a host of issues. He’s going to be looking at a host of criminal suits, I think. He’s probably still got to deal with some of those real estate transactions where he wasn’t paying his real estate, his property taxes. He would use … |

| Martin Sheil: | We talk about how he pumped up his financial statements to get loans from the bank, but then he would provide the New York State Finance Department, the real estate folks with minimal deflated type of financial statements to minimizing the value of his properties and assets in an effort to minimize his property taxes. This is nasty stuff. New York City Finance Department, they derive 40 to 45% of their revenue from the collection of property taxes. So when you evade property taxes, you are really hurting New York City. |

| Jeff Schechtman: | Are the real estate tax laws as loose today as they were during this period in the ’90s that we’re talking about? |

| Martin Sheil: | No. I think that it’s been some tightening up in terms of the shell companies. Years ago, you have all these Russians coming in and buying condominiums in Trump Tower anonymously through shell companies. Well, that has been addressed. The ultimate beneficial owners or buyers of these condos now have to be identified. So that’s been tightened up a little bit. Still the use of shell companies in real estate is just everywhere. It’s endemic. There are … I would point out that there are legitimate uses for shell companies, but real estate … If you’re into real estate and you own a number of houses or apartment buildings or whatnot, it makes sense to put each property in its own limited liability company for the purposes of risk management and minimizing your exposure to lawsuits. You don’t want to have all your properties subject to one lawsuit. So if you can minimize your exposure, that makes sense. Let’s face it. There are an awful lot of lawsuits between tenants and landlords. So that’s just a smart way to go about it. |

| Martin Sheil: | Now, it has been abused and they’ve tightened it up somewhat, but Donald Trump, on his last financial disclosure statement that he has to make as president, he indicated ownership of approximately 500 shell companies or LLCs, limited liability companies. That is just an awful lot, but it’s not unusual for someone of his ilk in terms of real estate holdings. It’s just an awful lot for any one regulatory authority to keep track of everything. It’s just … Hey, let’s face it. The IRS has lost quite a bit of resources and personnel over the years from attrition, and it’s hard for any one auditor or investigator to be able to take a look at one set of financial statements or tax returns that probably comprise hundreds of pages and be able to make sense of it without spending an inordinate amount of time and effort. |

| Jeff Schechtman: | Knowing the IRS as you do and from strictly a tax perspective, do you have a sense that any of this will be prosecuted? |

| Martin Sheil: | I hope something’s done tax-wise. The fact that the banks might have lost some money, I’m not going to lose any tears over that. What does bother me is when Donald Trump plays games with the tax authorities. He refers to it as making sport. Churchill once said that taxes are the price we pay for a civilized society. No one likes to pay taxes, but we do it in the course of fulfilling our civic duty to voluntarily comply with really the greatest tax system in the world. This system corrodes, however, when one of the richest and most famous members of our society pays little to no taxes and makes light of the civic duty, suggesting tax evasion is nothing more than sport. |

| Martin Sheil: | There’s no OLC opinion from the Department of Justice that provides President Trump with a free pass from paying his taxes whether he’s president or not. Spiro Agnew, when he was Vice President in 1973, was prosecuted for tax evasion by the United States Attorney’s Office in the District of Maryland. Agnew pleaded no contest to a single count of tax evasion while in office and resigned. I guess my feeling is if President Trump participated in a tax fraud scheme in the past few years, then IRS and DOJ need to fully enforce the tax law in order to maintain the integrity and viability of our voluntary tax compliance system. If not, then Leona Helmsley’s famous statement will be confirmed as correct. When she was referring to her wealthy contemporaries in the real estate and hotel business, she famously said “We don’t pay taxes. Only the little people pay taxes.” So as a proud little person, I sincerely hope Leona Helmsley is wrong. |

| Jeff Schechtman: | Martin Sheil, I thank you so much for spending time with us today here on the Radio WhoWhatWhy Podcast. |

| Martin Sheil: | It’s my pleasure, Jeff. As always, good luck. |

| Jeff Schechtman: | Thank you. Thank you for listening and for joining us here on Radio WhoWhatWhy. I hope you join us next week for another Radio WhoWhatWhy podcast. I’m Jeff Schechtman. If you liked this podcast, please feel free to share and help others find it by rating and reviewing it on iTunes. You can also support this podcast and all the work we do by going to whowhatwhy.org/donate. |

Related front page panorama photo credit: Adapted by WhoWhatWhy from 401(K) 2012 / Flickr (CC BY-SA 2.0) and The White House / Flickr.